The Latest from TechCrunch |  |

- Social Photo Aggregator Pixable Adds Intelligent Video Discovery

- Beat The GMAT Launches MBA Watch, A Social Network For MBAs

- Cloud-Based Game Streaming Service Gaikai Raises $30M From Qualcomm, NEA And Others

- BackBlaze Presents Their Bare-Bones, $7348, 135TB Storage Pod For Backup On The Cheap

- WePay Launches WePay Stores For Easy, Embeddable Storefronts

- Zillow Soars 200 Percent In First Trade With Over $1 Billion Valuation

- There And Back Again – How Cvent’s Founder Stood By His Company, For Better Or Bankruptcy

- Finally! Samsung Mobile Boss Promises Galaxy S II U.S. Launch In August

- Thrutu Brings Phone Call Multitasking App To The iPhone

- D-Link And OpenDNS To Bring Parental Controls To Your Router

| Social Photo Aggregator Pixable Adds Intelligent Video Discovery Posted: 20 Jul 2011 09:00 AM PDT Pixable, a startup that develops sleek social photo creation and categorization tools, is adding video discovery and sharing to its social photo aggregation app. Pixable’s Photofeed a Facebook app and companion mobile apps intelligently sorts and categorize your friends’ Facebook, Instagram and Flickr photos. Pixable will use the same technology used for ranking photos to surface videos shared on Facebook, Vimeo and YouTube. What makes Pixable unique is the company’s WonderRank technology, which sorts through a user's network to learn and find what has interested him in the past, and what might interest him now. The more you engage with Pixable, the "smarter" the app gets, and the better it serves your specific interests and preferences. For now, video discovery is only available in Pixable’s web application and will be extended soon to the startup’s iPad and iPhone apps. Since its launch in January, Pixable’s Photofeed has sorted and ranked over 10 billion photos for its 800,000 users. |

| Beat The GMAT Launches MBA Watch, A Social Network For MBAs Posted: 20 Jul 2011 08:30 AM PDT In April, 2005, Eric Bahn (a Stanford undergrad at the time) started Beat The Gmat as a blog about his efforts to study for the GMAT. It morphed into a general test-prep site attracting about 2 million student visitors a month. Today, it is launching MBA Watch, which finally gives some teeth to its claim to be the “Social Network For MBAs.” MBA Watch tries to pull together all the information about business schools and applicants in one place. MBA hopefuls can follow different schools like Harvard, Stanford, or Wharton (the site launches with 20 top business schools today). It creates the equivalent of a Facebook Wall for each school, pulling in official blog posts, Facebook Fan page updates, and Tweets about the school. You can toggle the stream between official sources and everyone talking about the school. The site also pulls together general stats like number of applicants, range of GMAT scores, and student demographics, as well as rankings and articles. On the applicant side, MBA Watch encourages members to share their own stats so that everyone can see who they are competing against. For each school, it will show a snapshot of average GMAT scores, average age, average years of work experience, and breakdowns by industry and college major. While not everyone applying for an MBA will feel comfortable sharing this kind of information, many already do on Beat The GMAT’s active forums. With MBA Watch, it is simply structuring that data and showing aggregate scores. Beat the GMAT already attracts an active community of pre-MBAs, and makes most of its money from sending students to formal test prep courses. With only four employees, it is on track to make between 700,000 to $1 million in revenues this year, up from $500,000 last year. And it’s completely bootstrapped. “I've only put $4 into the business to buy the Beat the GMAT domain name for 6 months,” says Bahn. He teamed up with David Park, a former McKinsey consultant with a computer science degree from MIT and a Harvard Law degree, who is now CEO. “Neither of us ever went to business school,” says Park.

|

| Cloud-Based Game Streaming Service Gaikai Raises $30M From Qualcomm, NEA And Others Posted: 20 Jul 2011 08:23 AM PDT Game streaming company Gaikai has just announced a new $30 million round led by NEA, with Qualcomm, Benchmark Capital, Rustic Canyon and Intel Capital participating in the investment. This brings the company’s total funding to over $40 million. Gaikai offers a server-based, cloud-gaming technology that streams games, allowing users to play any game inside the web browser. Gaikai's game streaming service hosts the games, runs them and then streams them to users, allowing them to interact with games wherever they are browsing. Gaikai is also planning to bring this functionality to video games and other interactive software. The company just landed a pretty big deal with Walmart to stream games for Walmart.com. The company already has a streaming deal in place with Electronic Arts. Gaikai faces competition from OnLive. |

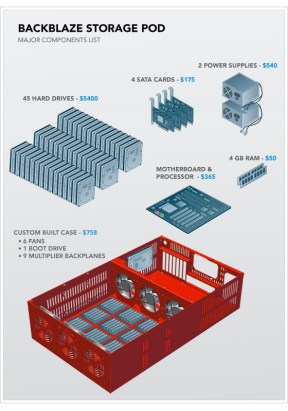

| BackBlaze Presents Their Bare-Bones, $7348, 135TB Storage Pod For Backup On The Cheap Posted: 20 Jul 2011 08:01 AM PDT We covered BackBlaze’s cloud-based backup system way back in 2008, when $5 for unlimited storage must have sounded like a Christmas presesnt. Since then the business has matured somewhat, but one thing they nailed that perhaps has become more important is scaling the hardware. With cloud backup and media services firing on all cylinders, data storage space is more valuable than ever, and providing the terabytes and petabytes of space is increasingly important to emerging companies. In 2009 BackBlaze was kind enough to let everyone in on the top-secret design specs for their “Storage Pod,” the custom server unit that they claimed made their prices possible (CEO Gleb Budman explains in this Ignite talk). And now they’re doing it again. Want to build your own ultra-low-cost storage solution for far less than the likes of Dell and HP? They’ve done the legwork and provided a part-by-part breakdown. Many items from the previous build are no longer available, which makes things difficult both for them and for aspiring cloud lovers. The new parts will likely die out in two years or so, but if anything the primary cost (the drives) will go down and the capacity will go up, while the other parts (motherboard, RAM, etc) will remain sufficient.

An unavoidable consequence is the greater magnitude of unit failure, but that’s something that can be controlled by redundancy at a huge scale, and certainly there are algorithms and top-secret software that make avoiding data loss like that a snap. I guess if a SATA controller were to go rogue (or something, I don’t know), even 135TB of lost data is manageable if you’ve taken the correct precautions. And the far more likely failure here (drives) don’t seem to be at any additional risk. The benefit of having lower cost hardware is obvious, but I think there’s something more to it than saving money. Being the master of your domain counts for something: BackBlaze is in control of their hardware in a way many companies aren’t, and they aren’t beholden to, say, Amazon or Dell for support or maintenance. Plus every part is easily replaceable and they designed the system (it’s really quite straightforward, not to say easy) so they know it top to bottom. Maybe it’s that forward-thinking leanness that almost got them bought? You can read far more technical details (such as file system changes and cluster stats) at BackBlaze’s blog. I build my own systems as well, and while I don’t have eight grand lying around to replicate their baby, I do like their style. |

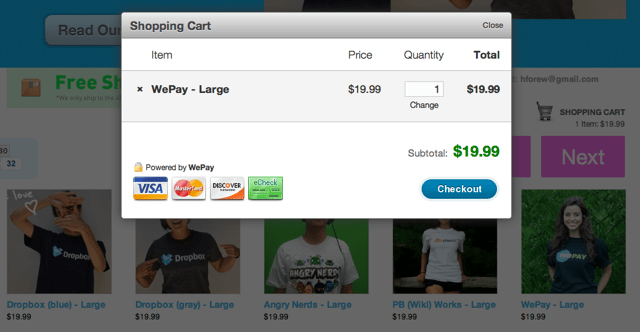

| WePay Launches WePay Stores For Easy, Embeddable Storefronts Posted: 20 Jul 2011 08:01 AM PDT Back in March 2010, WePay launched to the public as a group-payments platform — one that makes it easy to coordinate things like fraternity dues and bills that you share with your roommates. They’ve since expanded to offer event ticketing and support for donations, and today they’re launching a feature that puts it in even more direct competition with PayPal: WePay Stores. The feature lets any site integrate a storefront by inserting an embed code (sites can tweak the appearance of their new storefront using CSS). No merchant account is required to set up a store — you’ll just need a WePay account. You can see an example of a store at Startuptees, which has been using it for the last week. There are already other solutions that do this, but CEO Bill Clerico says that WePay Stores is easier for site-owners to implement because WePay is handling both the storefront and the transaction (other solutions often rely on a third-party, like PayPal, to handle the payment processing, so they can be more complex to set up). As for solutions like Shopify, Clerico says there are typically monthly fees involved with the storefront, in addition to payment processing fees. WePay is only charging for the payments (fees are 3.5% of transactions with no per-transaction cost), and sees the stores as a way to increase transaction volume. Ultimately, though, it’s probably in your best interest to compare the fees associated with each store, as your ideal candidate will depend on how much your average price point is. In addition to the embeddable store, WePay is also launching a Stores API that will let websites create merchant accounts on the fly (which is useful when a site wants to let users accept transactions). Other alternatives to WePay include Etsy and Weebly, both of which let you set up a storefront without having to know how to actually build a webpage. |

| Zillow Soars 200 Percent In First Trade With Over $1 Billion Valuation Posted: 20 Jul 2011 07:44 AM PDT Shares of real estate listings site Zillow began trading on the NASDAQ under the symbol ‘Z’ today, opening at $60 per share. This gives the company a whopping $1.6 billion valuation. Zillow priced its IPO at $20 per share yesterday, after upping the pricing of its IPO to $16 to $18 per share, from the initial range of $12 to $14 per share. While the stock price soared to $60 per share in first trade but has dropped to $43 per share. Zillow raised $69 million in the offering. According to Experian Hitwise, Zillow.com is the third most visited Real Estate site in the U.S and received 5.36% of Real Estate visits in March 2011, which is a 53% increase compared to March 2010. While Zillow is growing traffic, the company has been taking a loss in terms of net income for the past three years. But the company is cash-flow positive. For the years ended December 31, 2008, 2009 and 2010, the company generated revenues of $10.6 million, $17.5 million and $30.5 million, representing year-over-year growth of 49%, 65% and 74%, respectively. And during the three months ended March 31, 2011, Zillow generated revenue of $11.3 million, as compared to $5.3 million in the three months ended March 31, 2010, an increase of 111%. The company lost $12.8 million in 2009, and lost roughly half of that ($6.7 million) in 2010. The company, which launched to the public in 2006, also revealed that as of December 31, 2010, it has an accumulated deficit of $78.7 million. In the three months ended March 31, Zillow lost $826,000. Zillow CEO Spencer Rascoff told us in an interview this morning that the new funds will be used for headcount growth, especially for developers and salespeople. He says that mobile usage has helped grow the company’s revenue and when it comes to prduct development priorities, mobile development is at the top of the list. In terms of the timing of the public offering, Rascoff explained that the company was ready from business standpoint, but also believes the public offering helps company grow further. “Becoming a public company puts us on a whole new stage,” he says, “It’s like being drafted into the major leagues.” Underwriters for the include Citi, Allen & Company, Pacific Crest Securities, ThinkEquity LLC, and First Washington Corporation. Zillow currently lists over 100 million U.S. homes, including homes for sale, homes for rent and homes not currently on the market. Zillow launched a mortgage marketplace in 2008, and subsequently expanded into rentals and mobile, which has been a huge growth area for the company. LinkedIn also saw a significant pop from pricing ($43 per share) to $83 in the first trade. The company’s stock continued to rise in the first day of trading but subsequently fell over the next month. But LinkedIn’s stock has rebounded, opening today at $101 per share. Zillow’s pop is surprising considering the company has not made a profit yet. And a 200 percent increase in share value for the real estate listings company (which initially had a $500 million valuation) should only add fuel to the claims we are in a tech bubble. |

| There And Back Again – How Cvent’s Founder Stood By His Company, For Better Or Bankruptcy Posted: 20 Jul 2011 07:43 AM PDT (Note from TC staff writer Robin Wauters: As you may have read on this very blog, cloud-based event management software maker Cvent just raised a whopping $136 million in funding. I spoke to founder and CEO Reggie Aggarwal about the round yesterday, and he told me such an inspiring story about his experiences as a startup founder and dot-com era survivor that I asked him to pen a guest post on the subject.) Back in the late 1990s, in addition to working 60 hours a week as an attorney, I started the Indian CEO High Tech Council and organized networking events for local tech CEOs in Washington, DC, that had at least $10 million in revenue and 75 employees, or had raised $10 million or more in capital. I used to joke that it was a good thing I was the president of the group, because I'd never qualify for membership. Marketing to these CEOs, getting them to RSVP to the event invitations and securing their attendance was painful. I knew there had to be a way to streamline the process. Enter Cvent. I founded what is now the world's largest event management software company in September of 1999. I was 30 years old, living at home and borrowing money from my parents to fund my dream — I was like the Indian George Costanza. Those were wild times. I wasn't taking any salary and quickly ran up $250,000 in credit card debt; but lucky for me, as a Law grad, credit card companies practically begged me to open lines of credit with them. So, just before quitting law, I signed up for 10 cards to bankroll my idea. Everyone had a start-up back then. I thought it would be easy. It wasn't. I assembled an initial six-person team that filled the roles of technology, business and marketing. We all took massive pay cuts and worked out of broken-down offices — complete with the start-up lore of mismatched furniture and Wonder Bread sandwiches. Cue the dot-com explosion. Over the next year, we quickly raised $17 million in venture capital from the D.C. "tech glitterati" such as the CEOs of AOL, Nextel, Bell Atlantic and Nortel. We grew from 6 to 125 employees, and Forbes, the Washington Post, and USA Today wrote great articles about how we were going to transform the event industry. We were feeling good. Then, the dot-com bubble burst, September 11th happened and reality hit. Our world turned upside down, and we quickly fell from being a hot start-up to being the walking dead. We had less than $400,000 in the bank. Our revenue was $1.5 million and we were burning through a million dollars a month. The press completely turned on us and wrote articles that Cvent was going to wither like all the other dot-com companies. We had to cut expenses fast. We had originally planned to expand our headcount and had signed a five-year lease for space, but by 2001, we were just one payroll away from running out of money and were forced to cut 80% of our staff. We were left with an office for 250, but only 26 employees, and our landlord wouldn't reduce our rent unless I personally signed the renegotiated lease. I weighed signing a $1.5 million office lease and the prospect that if the company failed, I'd have to file for personal bankruptcy and would never be able to practice law again at a big firm. I had hit rock bottom. Not ready to give up, I asked my management team if they were ALL IN — needing to know that before I signed the lease — and with their support, I doubled down and essentially signed my life away. I personally guaranteed every loan and fought for Cvent's success. Over the next three years, life was a grind. We rolled up our sleeves to make the company work. Our CFO, a Harvard Business School grad and former BCG consultant, was collecting bills. We raised no In 2003, we turned the corner of profitability and the first rays of hope began to show themselves again. Today, Cvent is a highly profitable 800-person start-up. Yes, I mean start-up, because we will never forget where we came from and we never again take anything we have for granted. We've fought too hard to get to where we are and tremendous sacrifices were made. What follows are a few things I've learned along the way: 1. Do what you understand. I understand events. I can't build a Cisco router, but I can plan and market one hell of an event. 2. Build a solid team. In my darkest moment, I asked my management team if they'd stand by me. I worked for two and a half years without pay, and they took major cuts—but they stuck it out. Eleven of our 12 senior executives have been with Cvent since our inception. Building a team of great people is one of the most important things an entrepreneur can do. I have personally interviewed most of our 800 employees, because I believe the basis of a successful company is good DNA. We look for intrapreneurs – ambitious people with big ideas who are looking to bring those ideas to life in a more established environment. 3. Listen to the marketplace and create a culture of customer obsession. It is all about the customers. If you listen to them and deliver, they will stay loyal. Investment capital is important to businesses, but do not lose sight of the fact that your long-term staying power in a business is determined by your customers, not by your investors. Listening to your clients is what turns them from current clients to long-term customers. For example, through market research, we knew that our customers were facing a challenge when it came to finding the right venue for their event, determining if it was available, and getting pricing information. So, we created a tool that allowed them to do just that. We invested $25 million in solving that problem, and this year planners will book over $4 billion in meetings and events at hotels and special event venues using our system. 4. Know that it's a grind. To the outside world, a start-up seems glamorous. In actuality, it's a bunch of unglamorous days strung together to make a seemingly glamorous job. What's behind the scene is a lot of hope, determination and sleepless nights. In the two years that we were struggling to get Cvent back on its feet, I rarely slept, took no pay and traveled the country doing 150+ prospect presentations. It was less than glamorous, to say the least. 5. Be frugal. Learn how to grow without spending unnecessary money. Until just four months ago, our management team was using pop-up tables rather than executive desks. And even though Cvent is now at 800 employees, I still, to this day, share a room when I travel — and my colleagues are expected to do the same. We've learned to become conservative with how we use our money. 6. Invest when the competition pulls back. The last few years of the great recession were tough for U.S. businesses. Having been extremely frugal leading up to that point, we were in a unique position to advance by investing in our products and building the tools that our customers were requesting. Not many companies hired 150 people in 2009. That investment is paying off tremendously right now. 7. Find the right investors and stand by them. During the dot-com implosion, our investors stood by us. They didn't kick us out of the company because they believed we could turn things around. It was during that time that we were approached by other VCs and told to "wash out" our current investors by taking new money. Even though we were in a desperate spot, we held out and stood by our investors—as they had stood by us. In the end, what we ended up with was a self-sufficient company that created solid returns for our initial investors. In the end, the most important lesson that I've learned of them all is that you need to stand by your company and believe in yourself. As the old Chinese proverb says, if you fall down seven times, get up eight times. When I founded Cvent, I didn't think it would take 12 years to get to this point. Nothing is ever quite as easy as it seems. And in 2001, when we were about to go bankrupt, the public and press had written us off. But we stuck with it, and today I had the pleasure of announcing that we've received $136 million in funding from two of the world's largest investment firms. Perseverance and dedication pay off. |

| Finally! Samsung Mobile Boss Promises Galaxy S II U.S. Launch In August Posted: 20 Jul 2011 07:33 AM PDT It seems those leaked shots of the Sprint-branded Samsung Galaxy S II were the real deal. Samsung’s mobile boss Shin Jong-Kyun told Korean reporters that “we expect to release the Galaxy S II in the U.S. market sometime in August.” The iPhone competitor originally launched in Korea back in April, and then shortly thereafter in the UK. For almost three long months, we’ve had to sit here in the land of the free and the home of the brave, and watch as over 3 million Galaxy S IIs flew off the shelves in the first 55 days it was available. The specs are to die for, the hardware is gorgeous, and finally, we get to enjoy it. Those leaked pictures seem to ensure that the Galaxy S II will hit Sprint shelves, although we’re pretty certain that AT&T and Verizon will nab the beastly handset, as well. It’s predecessor, the Galaxy S, launched on all three carriers when it arrived, so it only follows that the S II will do the same. We really don’t know how to express just how excited we are that this phone is finally making its way across the pond, so the specs will have to do the expressing for us: The Galaxy S II touts a dual-core 1.2GHz processor underneath Android 2.3.4 Gingerbread, with Samsung’s TouchWiz 4.0 UI slapped on top. The 8-megapixel rear-facing shooter is capable of capturing video in 1080p, and the 2-megapixel front-facing camera should make you look pretty during your Google Video Chats. Plus, the Galaxy S II’s 4.3-inch 480×800 Super AMOLED display has the potential to rival almost any touchscreen out there. Hopefully, you’re not too attached to the Galaxy S II branding, as we’ll probably see this phone launch as the Samsung “Within”. Honestly, this phone probably deserves a more power-packing name like the “Awesome” or the “Badass” — but a rose by any other name would smell as sweet. [YonHap News via MobileBurn] |

| Thrutu Brings Phone Call Multitasking App To The iPhone Posted: 20 Jul 2011 07:25 AM PDT Mobile app startup Thrutu is bringing its in-call multitasking app to iPhone today. Thrutu’s Android app, which was launched four months ago, has already seen 250,000 app downloads. Thrutu, which is a division of Sequoia-backed Metaswitch Networks, allows users instantly to share photos, location, contact information and more at the same time as users are engaged in phone conversations on their phone. To access Thrutu, iPhone users can open the app and call any of their contacts (or Thrutu will start automatically when the phone receives an incoming call from a Thrutu user). You can then choose to share your location live on a map, snap and share a photo, send contact information and more. Thrutu is similar in some ways to Innobell, which adds another layer of apps on top of chat by allowing users to add and share maps to chats, YouTube videos, games and more.  |

| D-Link And OpenDNS To Bring Parental Controls To Your Router Posted: 20 Jul 2011 06:58 AM PDT Today's kids have grown up in a world where the internet has always been around, Google has always been there to help, and having a smartphone is the norm. It only follows that they'd be super comfortable with the web, using it just as proficiently, if not more so, than their parents. That's all well and good, but there's this one pretty huge problem: the internet is dangerous. That's why D-Link and OpenDNS have partnered to put OpenDNS on all new models of consumer model D-Link routers. If you haven't heard, OpenDNS provices security services for families who want to keep their kids off of nasty sites, and now the system will be built right in to D-Link routers. Customizing security settings is all taken care of during the initial router set up, and parents have the option to choose more overarching settings, or get specific by blocking individual sites. What sets this apart from other internet security systems or parental controls is that, since it comes through the router itself, OpenDNS controls every internet-connected device in the house. That includes laptops, desktop PCs, iPads, iPhones, Android devices, the Wii, XBox, and PlayStation, and anything else that hops onto your WiFi network. Since the OpenDNS lives on the router, it doesn't load your computer up with bloatware. Plus, the new D-Link routers with OpenDNS will keep your connection smooth and snappy. This is because OpenDNS has extra large caches that basically know the whole of the internet at any given time. Instead of throwing a DNS request to a server, waiting for the server to locate that page and produce it for you, OpenDNS servers already have the page ready, and are basically just waiting for you to press Enter. Despite the fact that this seems like a pretty great offering, we still have a couple complaints. Just because a parent doesn't want their kids on Reddit doesn't mean that those parents don't enjoy reading a good thread with their morning coffee. The OpenDNS integration on D-Link routers doesn't really provide a way for parents to override the pre-set parental controls. However, OpenDNS also has a deal in place with NetGear, and the customization settings on those routers does allow for specific computers to be protected from certain sites, while other devices can roam free. The HD Media Router 1000 (DIR-657), which has an MSRP of $149.99, is available now, while the Whole Home Router (DIR-645), which has an MSRP of $119.99, won't show up until August. |

| You are subscribed to email updates from TechCrunch To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment