The Latest from TechCrunch |  |

- In Defense of Reed Hastings

- How Entrepreneurs Can Create Their Own Luck

- With 4S Now Tops Among Big 3, Apple Grabs 52% Of Industry Profits; Doles Out Huge Bonuses

- Daily Crunch: Drop In

- PageLines To Launch An ‘App Store’ For WordPress Drag & Drop Sections, Plugins And Themes

- Ron Conway, FCC Chairman Genachowski And Other Tech Stars Team Up To Fight The Spectrum Crunch

- Hands On With The AppXRacer From AniApp

- The Groupon IPO: What’s Everyone Worth?

- Hands On With A Transparent iPhone

- Rap Genius Plans to Explain The Meaning Of Rock, Poetry and The Bible

- Don’t Launch A Company, Launch A Fund (Or The Series A Will Die)

- Loren Brichter, Creator Of Official Twitter Apps For Mac And iPhone, Leaves Twitter

- Liftopia: Because You’ve Always Wanted To Rent A Mountain

- Top Videos From TechCrunch Disrupt Beijing (TCTV)

- More Info And First Impressions: Canon’s New C300 Pro Cinema Camera

- Intel Itching To Work With Google’s Ice Cream Sandwich

- Kevin Rose Shows Me His Oink (TCTV)

- Masabi Secures $4 Million B-round From m8 Capital

- RootMusic Boosts BandPage Virality By Adding Like Buttons to Songs

- comScore: As Smartphone Usage Increases, Android Continues To Gain U.S. Market Share

| Posted: 05 Nov 2011 08:00 AM PDT  Writing in 2002, Peter Drucker, the great management consultant, foresaw the future. "In the next 30 years," he wrote, "power will shift to the customer – for the simple reason that the customer now has full access to information worldwide." And the stage for Drucker's great power shift – from the corporation to the consumer – is, of course, the radically transparent Internet, where nobody, it seems, can hide anything from anyone. But is this power shift to the customer good for today's digital economy? One supporter of today's radically transparent marketplace is Dov Seidman, the CEO of the consultancy firm LRN. As Seidman told me when he appeared on my TechcrunchTV show last weekend, this transparency will force companies to behave more ethically thereby creating both a fairer and more efficient economy. But what Seidman and many of the other apologists for radical transparency miss is the destructive economic cost of all this openness. Today's customer-centric Internet may be radically transparent, but it isn't either radically fair or radically efficient. The problem is that power has shifted so dramatically from the producer to the consumer that it is becoming harder and harder to build viable, long-term companies in today's fast moving and increasingly unforgiving digital economy. Take, for example, Reed Hasting's Netflix, which, in 90 nightmarish days, has been transformed from one of Silicon Valley's most impressive paragons of innovation into a company on the verge of a nervous breakdown. Just last March, MG Siegler was rightly gushing that Neflix was about to "shift" the entire cable television industry with its strategy of streaming originally produced content. But six months later, having increased its price by 60% for some customers earlier this summer, followed by a poorly communicated attempt to split the company into an analog and digital operation, Netflix has lost 800,000 customers and $12 billion in market value in 90 days – including a stunning $2.3 billion in one black day earlier last week. Some people are thrilled by this hyper-democratic run on Netflix, arguing that it reflects the general will of a consumer that will no longer put up with any kind of corporate ineptitude or doublespeak. One so-called "customer service guru", John Tschohl, even came on my TechcrunchTV show to crow that the arrogant Reed Hastings has got everything he deserved in this all-too-public humiliation. I'm not going to defend the undefendable and make excuses for Netflix's poorly executed strategic shifts this summer. But the problem with consumer and market reaction to corporate screw-ups in our age of radical transparency is that they lack any kind of scale. Up until this summer, Netflix ranked highly on customer service and was the poster child of innovation, offering an alternative business model to both iTunes and the cable providers. But today, with the company's market valuation tanking and with its continued hemorrhaging of customers, Netflix's focus is on its own survival rather than innovating an increasingly archaic industry. In the old days, before Drucker's great shift in power from the corporation to the consumer, a young promising company like Netflix would have had shelter from the intolerant storm of public opinion. And while I'm not arguing that we should (or could) go back to a pre-digital economy in which corporations are infinitely more powerful than consumers, we do need to discover a better balance between the almost instant destruction of today's digital marketplace and a consumer culture which is more forgiving of corporate screw-ups. So here's the solution. My message to all those dissatisfied Netflix customers who care about the future of the culture business: stop whining, show some generosity of spirit and foresight, and forgive Reed Hastings for his mistake. Uncancel your Netflix subscription and pay that extra couple of bucks a month for a service that is still unrivalled in its efficiency and still offers the most effective vehicle for building a 21st century customer-friendly subscription model. That way, Netflix can continue to innovate – which, in the long run, will be of incomparable value to consumers everywhere who want to enjoy high quality video entertainment on their digital devices. With more than 23.3 million members in the United States and Canada, Netflix, Inc. is the world's leading Internet subscription service for enjoying movies and TV shows. For $7.99 a month, Netflix members in the U.S. can instantly watch unlimited movies and TV episodes streaming right to their TVs and computers and can receive unlimited DVDs delivered quickly to their homes. In Canada, streaming unlimited movies and TV shows from Netflix is available for $7.99 a month. There are... Reed Hastings co-founded Netflix in 1997 with then CEO Marc Randolph and launched the subscription service in 1999. He currently serves as Chairman and CEO of the movie-rental company. In 2005, Time magazine added Reed to its “Time 100” list of the one hundred most influential global citizens. In March 2007 Reed was appointed to Microsoft’s board of directors. Earlier in his career, Reed founded Pure Software, which was acquired by Rational Software in 1997 after a successful IPO and numerous... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How Entrepreneurs Can Create Their Own Luck Posted: 05 Nov 2011 06:30 AM PDT  Editor's note: James Altucher is an investor, programmer, author, and entrepreneur. He is Managing Director of Formula Capital and has written 6 books on investing. His latest book is I Was Blind But Now I See. You can follow him @jaltucher. I’m in even worse trouble now. A few weeks ago I had to speak at Barry Ritholz’s conference but that turned out to be “only” a panel. It was a great panel but I knew I would only have ten minutes of time so wouldn’t need to prepare much although even then I was worried. Now I’m speaking for one hour at Defrag in Boulder, Colorado next week on November 9 and I’m terrified. For one thing, all of the other speakers are smarter than me. Right before me is Roger Ehrenberg speaking about “big data”. I’m not even sure what “big data” is so right off he’s smarter than me. Then Paul Kedrosky is speaking later in the afternoon about god knows what. Paul has an excellent blog obsessed with everything from economics to weather data. So despite my expertise in speaking I’m finding I’m a bit nervous. I could open up with the same line I used on Barry’s panel, “When I was walking over here I had an erection. Not so easy for a 43 year old without any stimulation whatsoever.” But this might not be the exact crowd for it. Technically, the title of my talk is “Success is a Sexually Contagious Disease” but I only gave them that title because it sounded neat and it was the title of a blog post I then published. But I have no idea if that’s what I’m going to talk about or if that’s something people will be interested in. The conference itself is about entrepreneurship. But I always am plagued by the fact that I’ve gotten somewhat lucky on this issue. My first company happened during the internet boom and I happened to be one of the few people around (at the time) who knew how to make a website. The second company I had, where Yasser Arafat was an investor, went down in flames in the Bust. The third company I sold was a venture firm. We were only sold because our top investor was so disgusted with us he wanted to buy out our ten year contract. And the third company I sold was Stockpickr.com, which I sold to thestreet.com that I already had a great relationship with. Another company that I made a decent living off was trading for hedge funds and then starting a fund of hedge funds. Everything else I did (about 16 other attempts at businesses) failed. So I guess right now I can see if it was luck or if I learned some lessons. 1) Luck is similar to “being at the right place at the right time”. So you can easily position yourself there. We know that the right place for right now is somewhere in social media. There are still many niches (plumbers, diamond wholesalers) that aren’t using social media correctly. The big agencies are ignoring them and they are too small and focused to understand how to use direct marketing via social media. If I were starting a business right now I’d either do lead generation via social media for a small but focused niche (diamond wholesalers, small restaurants) or I’d provide financing/lending for companies that are doing this and have established records of turning profits on money spent. I know several companies doing the above but it’s an incredibly wide, open, gaping hole in the industry. If I were a banker I’d look to buy companies all over the country in this space and then bring the combined entity public in the IPO boom that’s about to start happening. 2) My venture firm being sold I learned one thing: have at least one partner who is a great negotiatior. “Be bad” and someone will be willing to buy you usually doesn’t work. I was lucky there. Although, I will say, I had good, professional partners that knew how to negotiate very well. The one guy’s main technique was to act like we always had alternatives when we never did. And he would ignore the other party for a day or so while they got desperate. It’s a gutsy way to negotiate but it worked. Here’s part of the reason it didn’t work out for me as a big VC. 3) The mental health facility I sold I learned some very important things. Quantity, persistence, and story-telling. You need to hit everyone and then call everyone back twice. We must’ve made 30 calls and then 30 follow-ups to make sure we spoke with the right person. And then with each person we pushed to have a phone call with the company. Then once we had a potential buyer on the phone we had to make sure we told at least three different stories: how the was company doing (and was going to do ), the reasons why growth was a lock, and the reasons why management was incredible. Then we got the deal done. Which was a story unto itself. (Here’s my prior post on TechCrunch on how to best sell a company). 4) Stockpickr, as I mentioned before was a matter of being both proactive, and having friends in the right places. But it also was a matter of vigilance. I had a particular passion about how a financial community could develop with no news. I hate the news. It also was a matter of nourishing relationships built up over a five year period of non-stop work in the financial media space. So here’s how you “Create your luck”: A) As Wayne Gretzky says, “skate to where the puck is”. Don’t start a soft drink company competing against Coca-Cola. Start a company in a fast growing industry that has a wide, gaping hole in it. It’s not hard to identify those industries and holes. B) If you can’t create the company in that space, can you arrange financing for companies in that space through some of the techniques roughly described above. This still allows you to profit from the growth of the sector. C) Learn how to negotiate. D) Quantity. You’re never going to win if you depend on one potential buyer or one potential customer. The first time I tried to sell my company, Reset, I tried to sell it to HBO. I had only one potential buyer. No good and it didn’t work out. But the next time I tried I made sure I had ten potential buyers. Ever since then I almost get a reflux reaction in my stomach when I realize I’m back down to the one buyer-one customer model, which is never good. Create a market for what you are selling. The price will go up. E) Persistence. When we were selling the mental health facility there was one time we got a wrong number when we called a public company. We got switched to the wrong person in the company repeatedly. My business partner, Dan, kept calling until he finally convinced the operator she was connecting him to the wrong person. This was one of only 30 companies he was calling so he could’ve just left a message and given up. Instead he got someone on the phone eventually and she was the one who coughed up $41.5 million in cash, three times the closest other offer. F) Story-telling. Everyone is a little boy or girl at heart. We all want to sit on the floor and bounce a ball and watch Saturday morning cartoons. A story has a beginning, middle, and end. Make sure your story is down pat when you are talking with anyone about your idea, your company, your self (on a date, for instance). It doesn’t have to be so “planned”. But make sure you are constantly improving your storytelling abilities. For instance, before I gave a talk last week in Arizona I watched 30 minutes of Ellen Degeneres and Jon Stewart. Comedians are excellent story-tellers with perfect timing. G) Nourish relationships. The size of your network increases your luck exponentially. But relationships take Time to nourish. When I wrote here two weeks ago about “the 9 Skills for Becoming a Super Connector” I mentioned that I forgot why “Time” was on my list. Now I know: over time relationships get nourished. A simple connection becomes a friend, becomes family, becomes someone who actively wants you to succeed. That takes weeks/months/years to happen. Important to note: expressing gratitude across your network is the surest way to strengthen it. H) Passion. Luck will always follow your passion. Warren Buffett was, of course, extremely lucky that his passion was investing in 1950. But almost every passion can be used to make money if you have all of the above. Even if your passion is just “how do I meet the love of my life” and you apply all of the above you will “get lucky”, so to speak, and find success at your endeavor. I’ve had a lot of bad things happen to me in the course of being an entrepreneur. And sometimes I get down about it and it’s hard to pull myself away from the nightmare alley where the light at the end just becomes a fire that pushes me back. But when I do get to the end of the nightmare, and I apply these lessons, luck comes shining through and I can see again. Photo credit: Flickr/egazelle | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| With 4S Now Tops Among Big 3, Apple Grabs 52% Of Industry Profits; Doles Out Huge Bonuses Posted: 05 Nov 2011 06:14 AM PDT  As you’ve likely heard, there’s been a lot of upside that’s been reported of late when it comes to Android’s mobile OS. Thanks to Nielsen, we know that, yet again, Android is leader among mobile OSes, now accounting for 43 percent of U.S. smartphone marketshare, up from 39 percent in July; while Apple’s iOS remained at 28 percent over the same period, placing it in distant second. Of course, Apple has a little bit of vertical integration going on, and in spite of their lagging well behind Google in mobile software market share, iPhones are used by a full 28 percent of smartphone customers, making them top manufacturer for yet another quarter. Hardware leans significantly in Apple’s favor. So, while the iPhone made up a relatively small 4.2 percent of the mobile handsets shipped in Q3 2011, it seems that Apple is now accounting for over half of the industry’s profits. Yep. According to Canaccord Genuity analyst Mike Walkley, of the top eight cell phone vendors across the globe, Apple owns over 52 percent of the total operating income. And while that may seem impressive, that number is down from 57 percent in the second quarter. In comparison, Samsung owns 29 percent of profits among the top vendors, up from 18 percent last quarter, while HTC accounts for 9 percent, RIM comes in at 7 percent, with Nokia at 4 percent. Though Apple’s 52 percent share of the operating profits of the top eight vendors is impressive in spite of the relatively small percentage of iPhones shipped, Samsung’s meteoric rise is certainly worthy of note. According to Walkley, Samsung gained 11 points of value share thanks largely in part to the Android Galaxy S II, while RIM and Nokia continued to slip. Of course, while most groan over RIM’s future, at least Nokia is making a play at Windows Phone, hoping that its play into the U.S. market can turn a sinking ship around. That being said, the analyst (and firm) found that Apple’s new iPhone 4S was the top selling phone for AT&T, Sprint, and Verizon (the three largest carriers in the U.S.), with the iPhone 4 — in spite of its next-in-line now being sold — remaining a top selling model for each of those carriers. As 9to5Mac says, the phones get older, the margins seem to get better. And with the popularity of these phones increasing, Walkley projects that Apple may ship as many as 29 million iPhone handsets in Q4 2011. And that’s not all, as this succession of SEC filings shows, Apple’s executives are now reaping the rewards of a strong fiscal year (in which the company passed the $100 billion mark in revenue). The company awarded 1 million shares of stock to seven top execs, which will see bloated wallets for those of that remain with the company through 2016. The recently promoted SVP of Internet Software and Services Eddy Cue received 100,000 shares of stock in the form of a restricted stock units. 25 percent of Cue’s shares turn into freely tradable stock in September 2014, with the remainder vesting in September 2016. Each of the remaining six executives received 150,000 shares of restricted stock, with 50 percent vesting in June of 2013 and the remainder vesting in March of 2016. Based on the current price of Apple stock, that works out to a payday of approximately $60 million each for the execs who received the 150,000 shares. (Which includes: Scott Forstall, Senior Vice President, iOS Software, Bob Mansfield, Senior Vice President, Hardware Engineering, Peter Oppenheimer, Senior Vice President and CFO, Phil Schiller, Senior Vice President, Worldwide Product Marketing, Bruce Sewell, Senior Vice President and General Counsel, and Jeff Williams, Senior Vice President, Operations.) While Apple’s new CEO Tim Cook wasn’t mentioned in these new filings, he was awarded 1 million shares of stock upon his appointment as CEO, with 50 percent vesting in August 2016 and the remainder vesting in August 2021 (should Cook remain an employee of Apple). So, while Google continues to rise in mobile software, it seems that thanks to Apple’s hardware and its dominance around the world thanks to the iPhone 4 (and now the 4S), both Apple and its executives are cashing out. Thanks to Alistair Israel for the image Started by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple has expanded from computers to consumer electronics over the last 30 years, officially changing their name from Apple Computer, Inc. to Apple, Inc. in January 2007. Among the key offerings from Apple’s product line are: Pro line laptops (MacBook Pro) and desktops (Mac Pro), consumer line laptops (MacBook) and desktops (iMac), servers (Xserve), Apple TV, the Mac OS X and Mac OS X Server operating systems, the iPod (offered with... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 05 Nov 2011 01:00 AM PDT  Here are some of yesterday’s Gadgets stories: Samsung Focus Flash Review: High-End Feel At A Low Price WhiteyPaint Turns Walls Into Whiteboards Without Cramping Your Wallpaper's Style Four Stopgap Apps That Almost Fix Google TV 2.0 (And One Bonus App) Intel Itching To Work With Google's Ice Cream Sandwich | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PageLines To Launch An ‘App Store’ For WordPress Drag & Drop Sections, Plugins And Themes Posted: 04 Nov 2011 10:03 PM PDT  A year ago, at BlogWorld Expo in Las Vegas, PageLines announced the release of Platform, a drag and drop design framework for WordPress. The product offered some cool CMS design options, a drag-and-drop layout editor, and a fully configurable template builder for creating custom websites. PageLines’ Platform has since been downloaded 400,000 times and has become one of the most popular frameworks on WordPress.org over the last year. Back at BlogWorld Expo today, PageLines announced today that it will launch version 2.0 of its framework on December 8th, which will include a nifty new marketplace: The PageLines Store. For developers, designers, or people who want to build cool websites without worrying about coding, this should be of interest. The store is basically an app store for “drag & drop” sections, plug-ins, sections, and themes — all of which have been built by developers for the PageLines community. Apps in the store will range from drag and drop sections that customize the style of a website to an integrated system for eCommerce or a community forum and other functionality. For developers, the PageLines Store offers the opportunity to get exposure to several hundred thousand users, while taking a 70 percent cut of every sale. And developers get to set the price. The startup is also announcing the PageLines Developer Community, Workshops and LeContest, which will all be “focused around educating and helping designers and developers become successful with PageLines”, according to the startup’s blog post. In terms of the contest, all developers have to do is build a cool plug-in, drag & drop feature, etc., and PageLines will select a few of the best entries to launch at LeWeb ’11 in Paris this December. For more info, check the contest out here. As for PageLines v2.0, the new framework will include an improved layout editor, an intuitive UI, responsive design, dynamic color handling, and improved performance, says PageLines CEO Andrew Powers. The new framework will be sold via PageLines’ website, and the cost for a regular license will be $197. The developer version, which will include integrations for Mediawiki and Vanilla forum software, will be available for $397. PageLines sells and supports professional web-software for the self-hosted WordPress platform. PageLines is based in SOMA San Francisco, California (USA) and launched in mid 2009. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ron Conway, FCC Chairman Genachowski And Other Tech Stars Team Up To Fight The Spectrum Crunch Posted: 04 Nov 2011 09:46 PM PDT FCC Chairman Julius Genachowski, SV Angel’s Ron Conway, Andreessen-Horowitz’ Jeff Jordan, Twilio’s Jeff Lawson, Foursquare mobile VP Holger Leudorf and Lookout founder John Hering all gathered at Founder’s Den HQ this afternoon for the awesomely titled “Desperately Seeking Spectrum” panel, where discussion centered around freeing up broadband spectrum for the US mobile industry to use as it continues its formidable expansion. Genachowski referred to predictions that mobile broadband traffic will increase 35 times over the next five years. Smart phones, which use 24 times as much broadband, are replacing feature phones, and tablets, which are becoming increasingly more prevalent as they continue to displace the PC market, use 122 times as much as smart phones. “The apps economy didn't exist three years ago,” Genachowski said on why this spectrum hogging isn’t entirely a bad thing, ” And how many jobs are created per app? More than one, hundreds of thousands of jobs. Facebook has created around 15,000 jobs. And when you really look at the jobs that have been created by companies that are building to the Facebook platform and the jobs that are created by the mobile economy, they’re not just engineering.” Genachowski and the other panelists held that the techology industry — which is undeniably becoming more mobile-centric — is the primary catalyst for job growth in the US and an ample amount of broadband spectrum is crucial if we’d like to continue to be a (positive) disruptive force in the global economy. “As we build our products it's critical that we're reaching a point that we care about data,” said Foursquare’s Leudorf. ”The tech community wants to be proactive on this issue,” Conway explained, “We don't want to wait until it is a crisis.” Genachowski’s interim solution is something called voluntary incentive auction, which is why he and Conway are garnering support for measures that will allow the FCC to incentivize old school broadcast companies that voluntarily give up some portion of their spectrum allotment to mobile. A law that would give the FCC the power to hold these auctions is currently making its way through Congress, recently passing through a Senate committee with a vote of 21-4. “What we saw here today was a series of examples from entrepreneurs and innovators that are creating our economic futures. We know exactly what the biggest threat to them is, [that] the infrastructure they rely on is finite, spectrum is finite. Demand is going up, supply is flat,” Genachowski later told me in a duel interview with Conway. “If we don't increase the supply of spectrum we're going to throttle the growth, the opportunity and the job creation we can get from mobile innovation.” Special thanks!: @abrams Person: Ron Conway Ronald Conway has been an active angel investor for over 15 years. He was the Founder and Managing Partner of the Angel Investors LP funds (1998-2005) whose investments included: Google, Ask Jeeves, Paypal, Good Technology, Opsware, and Brightmail. Ron was previously with National Semiconductor Corporation in marketing positions from 1973-1979, and Altos Computer Systems as a co-founder, President and CEO from 1979-1990. He eventually took Altos public in 1982 and served as CEO of Personal Training Systems (PTS)... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hands On With The AppXRacer From AniApp Posted: 04 Nov 2011 08:36 PM PDT  If you’re a fan of the Parrot AR.Drone, you’ll probably get a kick out its earthbound relative, the AirXRacer by AniApp. I got a first hands on with this iPhone- or Android-controlled racecar in Shenzhen and you will be able to pick it up this holiday season. The car is a standard RC racer that, as you can see, is quite fast. You control it using your phone’s accelerometer or using an onscreen “wheel,” a method that offers a bit more finesse. The creator, Jeff Luo of AniApp Labs, said the cars would be available in Radio Shack and Brookstone this holiday and the apps are available now for download. It was a bit hard to video in the dark, but rest assured the control scheme was solid and the car was quite rugged, able to hit chair legs and ankles without shattering. No pricing yet, but look for it at a massage-chair dealer near you. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Groupon IPO: What’s Everyone Worth? Posted: 04 Nov 2011 08:19 PM PDT

After going from selling slippers with flashlights to being a 10,000 employee-strong business in three years, Groupon had its initial public offering today, to much fanfare and well, the opposite reaction. The offering was priced at $20 and experienced an exuberant opening pop of $28, which after a day of trading settled down a bit to close at $26. While Groupon’s co-founders and high-level executives notoriously took hundreds of millions off the table in an earlier round of funding, they still had notable skin in the game today, as evidenced by the share allocation on Groupon’s latest S-1. Biggest winner? Lightbank founder Eric Lefkosky, who is now a billionaire three times over with a solid 28.1% voting share. CEO Andrew Mason, by comparison, is now worth $1.2 billion in Groupon stock. VC firm Accel Partners and the Samwer brothers are also in enviable positions post IPO, each netting about a billion in Groupon equity for their troubles. It’s probably safe to say that just about everyone on this list is on a customary six month lockout with regards to selling their shares, and God only knows what the stock will be trading at then. While we all wait, here’s a video of Mason and I back when he Groupon features a daily deal on the best stuff to do, see, eat, and buy in more than 565 cities around the world. By promising businesses a minimum number of customers, Groupon can offer deals that aren’t available elsewhere. Groupon brings buyers and sellers together in a fun and collaborative way that offers the consumer an unbeatable deal, and businesses a large number of new customers. To date, it has saved consumers more than $300 million and claims it... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hands On With A Transparent iPhone Posted: 04 Nov 2011 06:51 PM PDT  Photos were a little hard to grab but I got to see a real, live “transparent” iPhone last night in Shenzhen. The kit is apparently quite easy to install – a few screws on the bottom and then you just slide off the back. I had seen kits advertised before, but this is the first time I’ve seen on in real life and, oddly enough, it’s kind of endearing. One more shot below, but it’s a clever and cool mod and it’s really striking, in a Visible Man sort of way, if you’re into modded iPhones. Click to view slideshow. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rap Genius Plans to Explain The Meaning Of Rock, Poetry and The Bible Posted: 04 Nov 2011 05:25 PM PDT  If rap lyrics like “Real G’s move in silence like lasagna” stump you, check out Rap Genius. The crowdsourced hip-hop lyrics explanation site will inform you that Lil Wayne is describing how skilled gangsters can assassinate someone without making a sound, like the letter ‘g’ in ‘lasagna’. But the three-man team behind Rap Genius aren’t satisfied with their current vertical. Today they told me they’re preparing to launch a site for rock music lyrics called Stereo IQ, and one day hope to expand to sites for country music, poetry, legal documents, and religious texts. While presently focused on user growth, the network of sites could monetize through sponsorships of brands mentioned in or related to the explained texts. Rap Genius Co-Founder Mahbod Moghadam tells me “Google wants to index all of text. But what’s more interesting is to try to explain all of text, anything that lends itself to line-by-line analysis.” While a lofty ambition, the bootstrapped startup site is off to a good start, receiving several million unique visitors a month. There’s plenty of runway in the industry, as Mogahadam says 2% of all Google searches are for lyrics. Dozens of lyrics sites now exist, but most are plagued with inaccuracies and awful user experiences cluttered with intrusive ads. This includes frontrunner MetroLyrics, which as of a few years ago had 13.5 million uniques a month and $10 million a year in revenue. Mogahadam and his co-founders were inspired by VH1′s Pop-Up Video, initially writing all the site’s explanations themselves. Eventually it opened up to contributors using a Wikipedia-style peer review system. Mogahadam says, “I had all this paranoia that the crowdsourced explanations were gonna be shit, but if you have a strong hierarchy of reviewers, crowdsourced content can be even better than using professionals.” Soon people started adding explanations to all sorts of text, not just rap lyrics. The site now features the Bill of Rights, excerpts from the Bible, rock songs, and poetry by Emily Dickinson. Currently, all this is hosted on Rap Genius but Mogahadam wants to launch standalone sites where tight knit communities can gather around specific content. When asked about Quora, which sometimes receives questions on lyric meanings, Mogahadam says “Mad respect for the guys who started it, but I think it’s too big — trying to do all of knowledge in one site. If you look at answers in areas other than technology, they’re not as good.” He says he’s willing to forgo the SEO benefits of a single site in favor of creating destinations that enthusiasts of particular verticals will keep coming back to for the latest explanations. For monetization, Rap Genius currently offers branded merchandise that doubles as promotion, and is reluctant to sell ads. I told the company I think it’s best bet is to get brands that are name-dropped in their lyrics or explanations to buy for sponsorships or site take-overs. If you just found out your favorite rapper is talking about Ciroc vodka or Audi automobiles in his songs, you might be highly susceptible to marketing from those brands. Rap Genius is quickly becoming the top result for some songs and seeing more “[song title] rap genius” queries. While individual rap lyrics can be difficult to decipher, standalone sites for rock, country, legal, and religious texts could provide macro-level analysis on what entire songs or passages mean. There’s also potential for the original authors to add official explanations that could draw more people to the sites. Says Mogahadam, “I want to see what The Strokes think about their own lyrics.” | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Don’t Launch A Company, Launch A Fund (Or The Series A Will Die) Posted: 04 Nov 2011 05:18 PM PDT  Editor's note: This guest post is authored by Adeo Ressi, who is the founder of The Founder Institute and TheFunded.com. You can follow him on Twitter here. Every investor and entrepreneur knows there is something scary about the current startup economy. There is an enormous amount of angel capital available, while at the same time there is a small amount of Series A and a large and concentrated amount of late stage capital. Industry insiders have affectionately dubbed this situation “the Barbell”, and it has become the most serious threat to the progress that startups have made — since 2008. At least nine out of ten high-quality angel-funded startups face an unnecessary death, because there is no Series A money to help them survive critical expansion. (See Rip’s post on the rise in late stage capital here.) In the last boom ending in 2008, there was approximately $30 billion in angel investments and another $30 billion in venture investments done every year. By most estimates, there is now as much as $80 billion in angel versus just over $10 billion in all stages of venture. Just 1 in 100 angel deals may get funded by venture capitalists today, yet there are probably at least 10 strong startups in a 100, if not more. As if this were not bad enough, estimates are that 70% of angel deals across the United States and a growing number of investments in other countries are structured as convertible debt. The debt needs to convert into Series A equity within a year, or the debt needs to be paid back. Investors regularly extend the debt that has come due for another year, since asking the startup to pay back the loan would bankrupt the business. With 10 or 20 angels of varying levels of sophistication in a deal, it only takes one angel to request a payback, and the company will go down. (Elad Gil has a smart post on TechMeme today that also analyzes this series A crunch.) The solution to this structural problem in the startup economy is simple: we need more venture funds. Unfortunately, thousands of funds around the world have been killed off since 2007. Just in the last three months, 1 of 4 of the top-rated venture capitalists on TheFunded have left their firm or the field altogether, so further declines in Series A investments are on the horizon. At this pace, the venture industry won’t hit bottom until 2014, after which turnover cycles in limited partners and growing returns from secondary markets should support new interest in the asset class. In the end, more funds will save the good companies and balance out the infamous barbell. All of this means that it is precisely the right moment to launch a fund. First, you have a large number of high-quality companies that need capital, while the competition to provide capital is decreasing. Second, you have a pool of frustrated limited partners looking for new managers. Finally, there are new forms of liquidity that are starting to drive returns, most notably the active secondary markets. It probably won’t get much easier to launch a new fund than it is right now, and the startup economy needs the help. A great source of these new fund leaders may be the hundreds of people setting up Y Combinator clones around the world. These seed-fund/ incubators require two to three million dollars per year to run, producing between 10 and 20 angel funded companies. Many of these will fail due to the high cost of annual operations without a functioning Series A market. The people that set these incubators up have already raised capital, so they are in a good position to set-up a fund. If you are really bold, like Dave McClure, you can run both an incubator and a fund, though there are some obvious conflicts of interest. Running a fund is not for everyone, but, if you think you have it in you, go for it. Now is the time. Another important note: There is the upcoming Founder Showcase on November 8th, where TC’s founder Mike Arrington will be the keynote speaker, and I am sure he will talk about the issue on stage at the event. Adeo Ressi is the founder of VC-rating site TheFunded and the startup incubator theFunded Founder Institute. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loren Brichter, Creator Of Official Twitter Apps For Mac And iPhone, Leaves Twitter Posted: 04 Nov 2011 05:03 PM PDT  Loren Brichter, the extremely talented creator of Tweetie — which begat the official Twitter applications for iOS — has just announced that he’s leaving the company. Brichter wrote in a tweet that today is his last day at Twitter, and that he’ll be “taking some time to figure out what’s next”. Brichter’s path to Twitter was an unusual one, and also the source of much developer angst. In November 2008 Brichter’s one-man company atebits launched Tweetie, a highly polished Twitter client for iPhone that quickly became a favorite among Twitter users. He followed that up with the subsequent release of Tweetie 2 in 2009, which was also a massive hit. Then, in April 2010 Twitter announced that it had acquired atebits and its iOS app — which later turned into Twitter for iPhone and Twitter for iPad. Tweetie for Mac, which was in development at the time of the acquisition, has also gone on to become Twitter for Mac. The notion of having an ‘official’ app was a huge blow to Twitter’s developer ecosystem, whose third-party apps had largely paved the way for Twitter’s success in the first place. But Twitter argued that the lack of official apps was causing confusion among new users, and so it stepped in with its own. Aside from the iOS and Mac apps,it’s also launched official apps for Android, Windows Phone, and Blackberry. Of course, it’s hard to fault Brichter for any of that — Twitter’s management was behind the decisions — and he created some fantastic applications. Twitter will doubtless miss him. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liftopia: Because You’ve Always Wanted To Rent A Mountain Posted: 04 Nov 2011 04:36 PM PDT  Finally, there’s a way for me to carve up the slopes with my pizza-wedge turns without having to endure the condescending smirks of strangers. That’s because Liftopia, the startup gives you steep discounts on ski tickets and other snow-related activities, has just added a new feature: full-mountain rentals. Which means you can keep the slopes to yourself if you’re willing to spend enough cash, or, if you wanted to go with a more pragmatic route, you could bring 249 friends or coworkers along with you. Depending on the resort, you’ll be able to rent an entire mountain beginning at $3,000. And if you don’t need to accommodate so many people, some resorts will let you rent out portions thereof (one venue will even let you rent a dedicated tubing hill). Liftopia is positioning the feature as a great idea for company off-sites or club snow days, which probably make more sense than my lone pizza-wedger fantasy. So far available rentals include Plattekill Mountain Resort (NY), Mt. Abram (Maine), Whaleback Mountain (New Hampshire), and Camden Snowbowl (Maine), and more will be coming soon. Liftopia, for those who haven’t used it, lets you order ski lift tickets ahead of time online, often with steep discounts (you can save up to 80% off the walk-up ticket fees at some resorts). It’s a largely win-win situation: consumers save money, and resorts can adjust their prices to suit demand, so they have fewer off-days. The company launched back in 2006, but because of initial industry skepticism it wasn’t until 2008/9 that things started to take off. It closed a $1.3 million funding round last month, and the roster is now full of well-known ski resorts. In fact, the company is also announcing today that it’s added the four famous Aspen/Snowmass mountains to its catalog. Here’s a breakdown on the pricing from the initial resorts for the full-mountain rentals, and more will be coming in the near future:

Image by Rod Cook on Flickr Liftopia is a complete online ski marketplace, offering the largest source of discount ski lift tickets online with added deals on rentals, lessons, dining and other mountain-related activities and products. With deals at more than 150 resorts across North America, Liftopia offers skiers and snowboarders the ability to buy date-specific lift tickets and other on-mountain activities online and in advance for up to 80% off the ticket window prices. Liftopia takes the hassle out of planning a ski trip... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Top Videos From TechCrunch Disrupt Beijing (TCTV) Posted: 04 Nov 2011 04:11 PM PDT  The sun has set on our first ever TechCrunch Disrupt conference outside U.S. soil. The Beijing event ended this past Tuesday, as OrderWithMe won the Disrupt Cup. With the 12 to 15 hour time difference between the U.S. and China, watching it live wasn’t the easiest option. We produced more than 60 videos. But here’s a look at some of the highlights you might have missed: Disrupt Cup Winner OrderWithMe’s Demo Pony Ma, Founder and CEO of Tencent Lei Jun, Co-Founder of Xiaomi, On How He Plans To Take On Apple In The Mobile Phone Industry Kai-Fu Lee on his start-up incubator InnovationWorks Cheezburger CEO Ben Huh: An Entrepreneur is Someone Who Doesn’t Understand The Word No Phil Libin, Evernote CEO on How Freemium Products Can Work TechCrunch Staffer Greg Barto Spins Around In A Barrel You can find all the Beijing Disrupt videos here and all the posts here. More news from Disrupt can be found in our posts on the Complete Guide to Disrupt Beijing Day 1 and Day 2. In addition to our regular Disrupt Music, which you can download here, we added a new track just for China. [download link] Company: OrderWithMe Website: orderwithme.com Orderwithme features daily inventory deals handpicked by their American team in China. Per the company’s claims as of March 2008, Tencent is China’s largest and most utilized internet services portal. The company powers popular products like instant messaging and gaming service QQ and e-commerce and online trading platform PaiPai, amongst others. Lei Jun is an angel investor in the Chinese economy, who has been likened to Ron Conway of Silicon Valley. Lei founded Joyo.com in 2000, which was later acquired by Amazon in 2004. He has also held positions at Kingsoft, leading the company to its IPO on the Hong Kong Stock Exchange. He currently is the board chairman of UCWeb, the leading Chinese mobile browser. Dr. Kai-Fu Lee is the Founder of Innovation Works. He served as Vice President, Engineering of Google Inc., and President of its Chinese Operations since July 2005. He is widely known for his pioneering work in the areas of speech recognition and artificial intelligence. Dr. Lee joined Google from Microsoft, where he most recently held the position of Corporate Vice President, after founding Microsoft Research China in 1998. Prior to joining Microsoft, Dr. Lee was a Vice President and... Evernote allows users to capture, organize, and find information across multiple platforms. Users can take notes, clip webpages, snap photos using their mobile phones, create to-dos, and record audio. All data is synchronized with the Evernote web service and made available to clients on Windows, Mac, Web, and mobile devices. Additionally, the Evernote web service performs image recognition on all incoming notes, making printed or handwritten text found within images searchable. Pony Ma is one of the Core Founders, Executive Director, Chairman of the Board and Chief Executive Officer of Tencent. Pony oversees the strategic development, overall direction and business management of the Group. Before he founded Tencent in 1998, Pony was in charge of research and development for Internet paging system development at China Motion Telecom Development Limited, a telecommunications services and products provider in China. Pony received his Bachelor of Science Degree in Computer Science from Shenzhen University... Ben Huh has always been a start up guy. His latest company, the Cheezburger Network, has been credited with bringing Internet memes to the mainstream and popularizing Internet culture. Ben founded the Cheezburger Network in 2007 and grew it into one of the largest humor networks in the world in less than two years — while making a profit during one of the deepest recessions. Ben credits the success of his company to the users and fans who create the... Greg Barto currently works at TechCrunch as an executive assistant to Michael Arrington. This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| More Info And First Impressions: Canon’s New C300 Pro Cinema Camera Posted: 04 Nov 2011 03:49 PM PDT  Cinema tech isn’t a big focus on TechCrunch, but with Canon it makes sense, especially when that cinema tech represents a major overlap with consumer gear. The Cinema EOS line introduced last night is just that, and I’ve just had the chance to get my hands on the new C300 digital cinema camera (and a little quality time with the new 1D-X as well). I also got to put a few questions to Chuck Westfall, from Canon’s R&D department. The most obvious thing about the new camera is how compact and handling-friendly it is. I sought out the most minimal setup, which is pictured above and (except for the lens) the default package for purchasing the C300. It was quite light and well-balanced, and the controls felt convenient for thumb or off-hand operation. While I doubt any AAA features are going to be filmed on this micro setup, it does demonstrate how minimal the minimum viable camera unit is. I’m actually surprised that it comes with a built-in EVF, which isn’t particularly high-resolution (1.5 million dots, somewhere around 840×600 pixels or so) and is redundant for many filmmakers. And it does increase the options available. I talked with Chuck Westfall about the camera, and he said that they had interviewed a lot of crews and cinematographers, who liked the small size and easy operation of DSLRs, but disliked the lack of ports and image quality issues. The C300 is a direct response to these concerns. The lenses, too, are designed with motion photography in mind. The 360-degree focus ring and stepless iris (which feels smooth as butter and would be really nice to have in certain situations) are cinema-oriented, and they even gave the elements a different coating to reduce contrast and leave more up to the filmmaker. How the iris, which doesn’t use traditional stop numbers, will record or communicate that data to the camera is unclear, and Canon reps couldn’t answer my questions, citing the fact that most of the gear was pre-production. But they did confirm that aperture control is totally manual. I asked about the choice to go with 1080p; RED’s announcement last night puts 4K recording at a very reasonable price and I was wondering whether Canon felt threatened. Westfall explained that “for an initial product” in the C series, they wanted it to fit into as many existing workflows as possible. Although 4K is clearly in Canon’s future (as demonstrated by the announcement of the 4K DSLR concept, they wanted to put something out that would plug right into the many productions that are shooting in 1080p. Which is a lot — you’d probably be surprised to hear how many are still shooting to tape or film. As for RED’s product and how it related or competed with the C series, Westfall said diplomatically “the market is going to tell us which approach they prefer.” And while it’s true that RED’s Scarlet represents a serious value, the totally new workflow is only just beginning to make inroads on the industry at large, and the familiar Canon systems will still be preferred by many. Westfall convinced me of the company’s dedication to getting as much accuracy and quality from the sensor as possible, but comparisons will have to wait until the C300 hits studios. Quick hands-on with the 1D-XThis thing is a beast. It’s enormous, heavy, and it takes pictures like a machinegun shoots bullets. I have serious gear envy. Without looking closely at the shots it’s hard to say, but I saw a big increase in noise after around 12800 (naturally) – but it was a nice even noise pattern, not too chroma-y. The rapid fire is ridiculous. It’s very pro. Any real impressions other than this would take more time and more comparisons with other cameras and such, so I’ll just leave it at that. Specs and such are here. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Intel Itching To Work With Google’s Ice Cream Sandwich Posted: 04 Nov 2011 02:36 PM PDT  Intel hasn’t been able to make much of a dent in the smartphone or tablet markets, but they’re not about to give up just yet. ComputerWorld reports that Intel is working to make Ice Cream Sandwich-powered devices a part of their future. The mobile space represents a huge opportunity for Intel, which is made all the more maddening because they’ve never really been able to crack it. Less than a handful of Intel-powered Android tabs ever saw the light of day, and most (like the Cisco Cius, which ran Froyo of all things) were geared heavily toward enterprise use. Meanwhile, if you were to peer into the innards of nearly any smartphone or tablet on the market, you would likely see an ARM-based processor. It’s a reality that can elude some, as processors can bear ostentatious names like Snapdragon and Hummingbird that obscure the nature of their architecture. Now, it looks as though Intel is about to roll their sleeves up and fight ARM’s onslaught. Intel showed off some frankly impressive smartphone and tablet reference designs at a developer event back in September, both of which ran on Intel’s Medfield plaftorm. The company has also promised that the first Intel-powered smartphone would see the a release sometime next year, so it’s apparent they’re beginning to get the lead out. Given that Intel has their eye on both the smartphone and tablet markets, their apparent zeal for Ice Cream Sandwich makes complete sense. Ice Cream Sandwich is intended to be Google’s unifying OS, one that will bridge the experience gap between smartphones and tablets alike. If Intel can ensure that Ice Cream Sandwich will run without a hitch on whatever mobile chipset they go with, they stand a serious chance at popping up in your next tablet. For the time being though, Intel is stuck playing the waiting game. According to an Intel spokesperson, Ice Cream Sandwich “includes OS optimization for x86,” so the actual work of getting ICS running may not be too difficult. Still, a concerted effort can’t begin they actually get their hands on the software, so Intel still has a little while to go before they get cracking. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Kevin Rose Shows Me His Oink (TCTV) Posted: 04 Nov 2011 02:35 PM PDT  Yesterday, Kevin Rose’s new mobile app, Oink, hit iTunes. You can download the app, but you still need an invite to unlock all of its features. About an hour after the launch, I showed up at Milk, Rose’s mobile lab startup, near San Francisco’s Mission District to get a demo. In the video above, Rose takes me through the app and explains what he is trying to accomplish. Oink is a location-aware app that lets you rate things in specific places and uses hashtags to identify those things. So you can rate the #sushi at a Japanese restaurant, the #burrito at a Mexican place, or a #bikepath in a park. You can rate anything, just add a hashtag or see what’s popular nearby. You snap a picture and rate the thing, then other people can add their ratings so that you can see the best #sushi or #beer ranked by location. You can gain cred for a particular hashtag if other people add their votes to yours. Once Oink learns what things you are interested in, it can start showing you the best #tea, #sushi, or #beer wherever you happen to be. If Rose can get people to use this app and collect data about the real world, there are all sorts of interesting things he can do, from real-world recommendations about the things you care about to hyper-targeted offers. Milk is a mobile development lab founded by Kevin Rose, Jeff Hodsdon, and Daniel Burka. Milk has announced its first mobile app, Oink, to be released this fall. Person: Kevin Rose Website: kevinrose.com Kevin Rose is an angel investor and serial entrepreneur. He is the Co-Founder of Milk and previously the founder of Digg and WeFollow. Rose also co-founded Revision3, and Pownce (acquired by Six Apart). In addition, Rose is also the co-host of the tech news podcast Diggnation and founder of Foundation, a private newsletter and podcast. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Masabi Secures $4 Million B-round From m8 Capital Posted: 04 Nov 2011 01:19 PM PDT  Masabi, which develops mobile ticketing technology for the transport sector, has secured $4 million from London-based m8 Capital, the majority-owned affiliate of AGC Equity Partners that targets mobile startups and technology. This is a B-round, following the $2m A-round of last year and is designed to push the company into the US. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RootMusic Boosts BandPage Virality By Adding Like Buttons to Songs Posted: 04 Nov 2011 01:09 PM PDT  RootMusic’s BandPage, Facebook’s most popular music app, just upgraded to HTML5 and now includes a powerful new viral channel. Using the Open Graph capabilities launched at f8, all songs within the app’s musician profiles now include Like buttons that instantly share playable tracks to the news feed. RootMusic’s Director of Pages Matthew Conn tells me “I would expect very large increases in sharing”. Considering BandPage has 28.6 million monthly active users, the volume of songs shared could be massive. The updated app will make the news feed a better place to discover music, and since BandPage doesn’t auto-share listening activity like Spotify, there’s no risk in exploring. Without an official solution from Facebook for artists who want to stream their music, RootMusic’s BandPage has snowballed to host over 300,000 musicians. The company employs a freemium model built for bands scrounging to make rent, with most functionality offered free and premium accounts costing just $2 a month. Still, competitors including ReverbNation and Bandcamp are trying to undercut RootMusic by offering entirely free apps that instead charge musicians to sell their songs. To stay ahead, RootMusic has been steadily releasing new features and making more of them free. While snazzy video players and customizable design improve the experience for existing fans, what most bands really want is exposure that nets them new fans. That’s what this update is about. When users play a song or video on a BandPage they’ll now see Like and comment buttons that let them share media that can be played in-line from the feed. Previously, users had to click multiple times through a foreign proprietary sharing flow to publish songs. Conn tells me BandPage’s faster, more familiar sharing flow will increase clicks because “users now do what they’re used to doing on Facebook: Liking and commenting.” More sharing means more friends listening to songs in the news feed and clicking through to artist BandPages. This virality will help bands gain new fans and drive downloads and concert tickets sales. In turn, today’s update makes BandPage a better streaming solution that more artists will want to use and pay for. The Music Experience made for Facebook - Listen, Share, Discover. Make the Move to BandPage on Facebook. We founded RootMusic to level the playing field; we turn two days of hard work into two clicks online. Whether it’s your band’s first gig or scheduling your second arena tour, RootMusic gives you the power to get it done. BandPage by RootMusic is the industry’s leading social media promotion and distribution platform that directly turns revenue for the artist. Integrations with... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

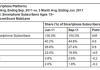

| comScore: As Smartphone Usage Increases, Android Continues To Gain U.S. Market Share Posted: 04 Nov 2011 12:39 PM PDT  ComScore just released its U.S. mobile subscriber numbers for the three-month average period ending September 2011. According to the report, 87.4 million people in the U.S. owned smartphones during the three months ending in September, up 12 percent from the preceding three-month period. Google’s Android OS was top smartphone platform with 44.8 percent market share, up 4.6 percentage points from the prior three-month period. Apple continued in the second position, growing 0.8 percentage points to account for 27.4 percent of the smartphone market. RIM ranked third with 18.9 percent share, down 4.6 percentage points from the preceding period, followed by Microsoft (5.6 percent) and Symbian (1.8 percent). During the time period, 234 million Americans age 13 and older used mobile devices. Samsung ranked as the top manufacturer with 25.3 percent of U.S. mobile subscribers (steady from the previous time period), followed by LG with 20.6 percent share and Motorola with 13.8 percent share. Apple came in at number 4 with 10.2 percent share of mobile subscribers (up 1.3 percentage points), while RIM rounded out the top five with 7.1 percent share. comScore says that more than 40 percent of mobile subscribers us browsers and applications in their daily use. Browsers were used by 42.9 percent of subscribers (up 2.8 percentage points), while downloaded applications were used by 42.5 percent (up 3 percentage points). In September, 71.1 percent of U.S. mobile subscribers used text messaging on their mobile device, up 1.5 percentage points. Accessing social networking sites or blogs via mobile phones increased 2.4 percentage points to 31.5 percent of mobile subscribers. And mobile game-playing was up by 1.9 percentage points to take 28.8 percent of the mobile audience, while 20.9 percent listened to music on their phones (up 1.9 percentage points). Since this study only went up to September, it should be interesting to see how the newly released iPhone 4S, and the addition of the Sprint network, helps boost Apple’s U.S. mobile subscribers. |

| You are subscribed to email updates from TechCrunch To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment